Cyber 5 is widely considered the most important 5 day stretch for online shopping in the US. These 5 days have accounted for 12%-16% of total online holiday sales (November 1- December 24) every year since Thanksgiving Day started becoming an important online shopping day (around 2013, largely driven by the rapidly increasing popularity of smart phone adoption). This year’s Cyber 5 was different. Online sales during Cyber 5 were lower than what every research firm had forecasted (including, my firm, NetElixir).

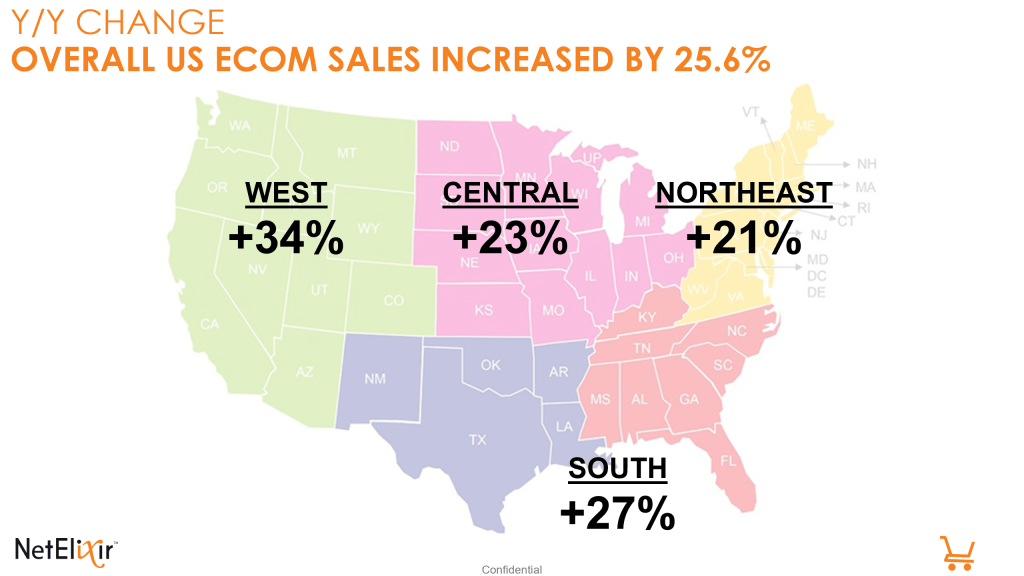

25.6% Y/Y growth in online sales may seem like a strong growth number. However, when we apply the context of in-store sales decline during this period (https://www.cnbc.com/2020/11/28/black-friday-traffic-in-stores-craters-52percent-during-pandemic.html), they look a lot less impressive. The total retail sales in the US are likely to either remain flat Y/Y on even experience a slight decline.

So, what happened? Why aren’t Americans buying as much?

There maybe multiple factors at play here. I wanted to highlight a few of them.

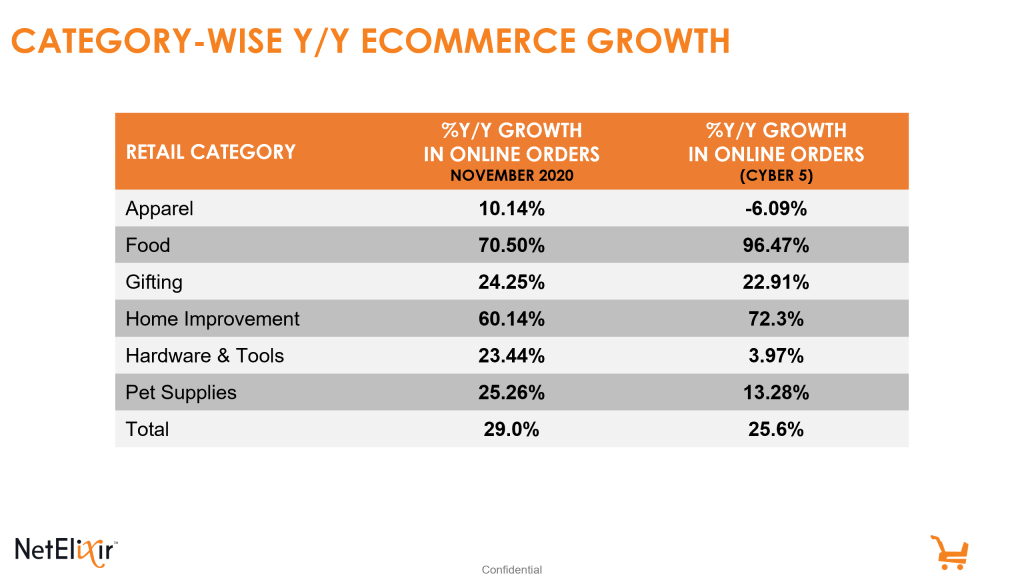

- Shoppers shifted their spend to retail categories that are classified as essential (food & gourmet, pet supplies) or one that’s experiencing a pandemic-led bump (home decor, home furnishings, DIY tools).

- Shoppers didn’t invest much on retail categories (that are normally strong during holidays) like apparel & fashion, accessories, jewelry and (surprisingly) consumer electronics. Even in a category like beauty products, the sales of make up kits have gone down by 36% (https://www.glossy.co/beauty/beauty-e-commerce-black-friday-bright-spot/).

- The overall economic uncertainty has definitely impacted online purchases this year. (https://www.therobinreport.com/nrf-holiday-forecast-at-risk/).

- Many retailers as well as logistics giants like UPS, have been encouraging shoppers to start their holiday shopping early this year (https://www.cnn.com/2020/10/25/business/holiday-package-delivery-crunch-fedex-ups-post-office/index.html). As a result of this the total online sales numbers during November has been stronger than the Cyber 5 online sales number. NetElixir Retail Intelligence Lab Analysis shows that Y/Y eCommerce Sales increase was 29% (vs. 25.6% Y/Y growth during Cyber 5).

- Many experts had thought Prime Day may kick start holiday shopping early this year. Our research shows that this did not happen. There was a sales slump post Prime Day that continued until the election week. Looking back, it is not clear if Prime Day in October actually cannibalized some of the Cyber 5 sales. (In any case, it helped Amazon grow its share of US Online sales).

- A slow Cyber 5 may also indicate the setting in of shopping fatigue. 10 months of restricted activity has led to fewer purchase options for shoppers (how many home decor items and DIY tools can you continue buying?). Also, predictions of a dire winter are not helping spruce up the “holiday shopping mood”.

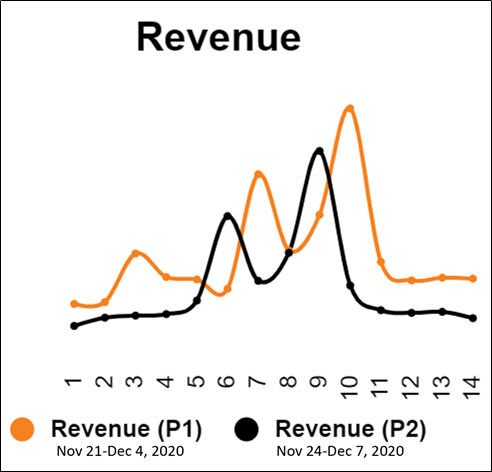

- Even though the Cyber 5 sales have been slow, the post Cyber Monday sales have been strong. Below is a chart comparing 14 day sales trends until 4 days after Cyber Monday. This maybe a result of fast approaching shipping cut off dates (for on-time delivery for holidays).

The remainder of the holiday season will most likely see even greater level of uncertainty due to product stock outs and shipping restrictions and (unfortunately) the rapid increase in number of active cases. The Y/Y ecommerce sales growth in December may get restricted to 13% Y/Y thereby limiting total online sales growth during Nov-Dec 2020 to 19% Y/Y. I must admit that this is one forecast where I hope I am being too conservative.